Want to make extra money in your sleep? I recommend Drop, a new app that gives you cash back for doing your normal everyday shopping. Sign up for Drop now and get an instant $5 bonus!

Welcome to the Wealthy Nickel Extra Income Report! Each month, I share all the different ways we make extra income outside the 9-5 job.

For a little background, I decided to share my side hustle income for a few reasons:

- To show you exactly how I make extra money while working a full time job

- To keep me accountable to my goals, and

- To inspire you to start your own money-making ventures on the side.

My family lives on a single income, and we are blessed that that income is enough to pay the bills and put food on the table. But we decided several years ago that we wanted to pursue financial independence and be able to “retire” (whatever that means) long before we hit 65.

In order to do that, we needed to supercharge our savings, which was not going to happen on a single income. We needed to figure out how to make additional income, but with 2 young kids we needed something that didn’t require a huge time commitment. Hence our first side hustle (real estate rentals) was born.

Since then, we’ve tried lots of different side hustles. As we experiment with new ideas, I will share our strategies here. None of this is rocket science, but my hope is you will be able to learn from our extra income projects and apply what you learn to your own projects.

There are a million different ways you can earn extra income on the side, and I certainly haven’t tried everything. There are a lot of good ideas out there that may be a better fit for you. If you want to get some more ideas, I have a Side Hustle Interview Series that documents creative ways others are making money on the side. In addition, I recently contributed to an article that has a lot of great ideas for side jobs you can start without any money.

With that out of the way, let’s get to this month’s income report!

Extra Income Goals for 2019

While we made over $100k in 2018 from side hustles and passive income, I don’t think that’s a realistic goal for 2019. Almost half of that income came from a flip and wholesale deal we did, and we made the decision to ramp down our flipping business while we have very young kids.

Since we’ve been making moves with our real estate portfolio to make it more passive, I do believe our private equity cash flow should increase this year to make up for some of our lost active income.

- Cash Back Apps: $500

- I started looking for the best cash back apps in September of last year, and think between my wife and I we can make $500 per year with minimal effort.

- Credit Card Rewards: $1,000

- It’s time to sign up for another couple of rewards credit cards this year. If we can get 2 cards with a $500 bonus each, we’ll knock this one out easily.

- Interest Earned: $1,000

- Since selling off some of our real estate, we’ve slowly been moving money into crowdfunding or other things. But we have a decent amount of cash laying around. I’m currently earning 2.2% at Ally Bank right now, but need to switch over to CIT Bank as they are paying 2.45%!

- Realtor Commissions: $15,000

- My wife has been able to make $15-20k the last few years just from random friends and family transactions. There’s no business in the pipeline, and we don’t do any marketing, but something usually pans out throughout the year.

- Real Estate Crowdfunding: $25,000

- We have a significant chunk of money in real estate crowdfunding and other private equity deals. Some send us a monthly or quarterly check, while others won’t pay us a dime for 5 years or more. Based on the types of deals we’re in, I think we should be able to get $25k in passive cash flow delivered to our mailbox in 2019 🙂

- Rental Properties: $25,000

- We don’t have any big plans to buy or sell any rental properties this year. My goal is to make $300 cash flow per month for each of our 7 units, which comes out to just over $25k.

- Blogging: $500

- Right now blogging is a fun hobby that has cost me a few hundred dollars so far. I’m hoping in 2019 I’ll be able to turn a small profit. We’ll see!

- Total Extra Income Goal: $68,000

Most of our extra income relies on real estate, which is very lumpy. But on average, our goal is to make $5,667 per month.

Extra Income for March 2019

- Cash Back Apps: $7

- Credit Card Rewards: $0

- Interest Earned: $234

- Realtor Commissions: $10,191

- Real Estate Crowdfunding: $758

- Rental Properties: $3,853

- Blogging: $215

- Total Extra Income: $15,258

In total, we made $15,258 this month! This has been our best month since we started tracking our side hustle income, due mainly to my wife finishing up a real estate transaction and collecting her commission check. That one check gets us pretty close to our annual goal for realtor income, which is great because there are no other clients on the horizon.

Our side hustle income is generally very lumpy and depends heavily on when my wife pulls in a real estate commission check, or if we have a big repair bill on a rental property.

Side Note: We’ve been building side income streams for over 5 years now, so if you’re just getting started, don’t get discouraged by the amount. Everyone has to start somewhere, and we probably LOST money the first several months of our side hustle journey.

Related: How We Got Started on our Side Hustle Journey

2019 Progress Toward Extra Income Goal

In March, we jumped ahead of our goal to be at $17,000 by the end of Q1. This was in large part due to my wife’s realtor income this month, which we don’t expect to happen again anytime soon.

Exciting Update! We Closed on a Flip Property!

Through a realtor friend of my wife’s, we came across a property almost 2 years ago that was part of an estate and needed a lot of work. We put in an offer and it was accepted. At the time, I thought the probate process would be wrapping up soon, the estate would be settled, and we’d be closing in the next few months. How wrong I was…

After almost 2 years of back and forth, and distant family members contesting heirship, we FINALLY closed on the property in March! I didn’t put it into our 2019 goals because I honestly didn’t know if we would ever close on the house. The good news is we basically bought a house in 2019 for 2017 prices, although after sitting vacant for a couple years it will probably need more work than we originally budgeted for.

We paid $80,000 for the house, and as of right now it looks like it needs another $80-90,000 worth of work. We will be redoing EVERYTHING – kitchen, baths, floors, roof, plumbing, etc.

When we initially put it under contract, we were imminently expecting our second child, so we decided to partner on the deal with another couple we know that invests in real estate – we would bring the deal and they would run the rehab. As it turns out, that second child is now 18 months old, but we are still partnering with them. Hopefully with them doing the bulk of the rehab work – getting bids, managing contractors, etc. it won’t take too much of our time and we’ll both make a good paycheck at the end.

Stay tuned to see how things work out! We hope to have the property on the market by June.

Cash Back Apps – $7

I have a goal to make an extra $500 per year from cash back apps. $500 per year breaks down to about $42 per month, so we under-performed quite a bit in March after a great month in February. My wife’s credit card was hacked, so she had to get a new one. Consequently, we forgot to link the new card to the apps and didn’t earn any rewards from her spending.

The beauty of cash back apps is that they require almost zero work. It’s basically free money if you do any shopping with credit cards, and the cash back stacks on top of your credit card rewards. In this day and age, between credit card rewards and cash back apps, you should be able to make at least 3-5% back on every purchase you make.

I have downloaded dozens of cash back apps in search of the ones that pay out the most money for the least amount of work. Once I determine which ones work best, I get my wife to sign up (using my referral code of course for an extra $5-10 bonus). Since my wife does most of the day to day shopping and online purchases for our family, she’s really the one making most of the money.

Related: The Only 2 Sites You Need to Make $100 A Month Taking Online Surveys

How I Earned Cash Back This Month

I got one referral to Dosh, and also made a few dollars on Drop from my normal shopping at Trader Joe’s, Starbucks, and Chipotle. While it wasn’t much money, I also didn’t have to do anything to make it!

As of March 2019, here are the apps on my phone:

Drop

Drop is one of my favorite apps because it doesn’t require me to do anything at all. I just downloaded the app and linked my credit card. Now when I make purchases on my credit card, it automatically adds points to my account.

Drop lets you pick 5 stores where you get automatic cash back every time you shop. The 5 I picked are Trader Joe’s, Target, Walgreens, Starbucks, and Chipotle. I earn Drop points (1,000 points = $1.00) each time I use my credit card at these stores.

There are other offers within the app if you want to actually check it every once in awhile. I recently signed up for an offer to set up an account with Stash, an online savings app, that I had been meaning to try out anyway. I will get 15,000 points ($15) just for signing up for a free app through Drop. So these offers can be worth it if you find something you can use. You just have to be careful to avoid signing up for things you don’t need just for the cash rewards.

If you want to try it out you can sign up here and get a $5 bonus when you link your credit card (that is an affiliate link – I get a small commission if you join that helps keep the lights on around here).

Dosh

Dosh is very similar to Drop – once you link a credit card you don’t have to do anything else but collect your cash. Where Drop let’s you earn cash back at a set of specific stores that you choose, Dosh gives you cash back at wider range of stores. I’ve noticed that Dosh tends to have a lot of local restaurants in its list (usually with 5% cash back).

One of my favorite local restaurants that I frequent gives 5% cash back through Dosh. It’s not a huge amount of money, but it’s nice to see my cash balance in the app increase every time I take the family out to eat!

Update: As of 12/5/18, Dosh offers cash back on online shopping without having to click through the app! This is a game changer, and as far as I know they are the first to do it.

I pretty much ignore the online cash back offers through most apps because I don’t want to have to remember to go through the app every time (Ebates is the exception because they have a handy Google Chrome extension that does it for me). Now when you purchase online through one of Dosh’s partners, as long as you use your linked credit card, you will get the cash back automatically.

You can sign up to try Dosh through this link and get a $5 bonus (again, that’s my affiliate link).

Ebates

Where Drop and Dosh give you cash back for local shopping, Ebates is all about online shopping. If you’re like my family, we buy everything we can online, and Ebates helps us save 2-5% on almost every purchase.

When I first signed up for Ebates a few months ago, I was able to get about $15 for booking a hotel through Expedia (which I was doing anyway). So not only did I get the lowest price I could find online, I got an extra $15 back in my pocket.

The only downside to Ebates is you have to start your shopping in the Ebates portal so that it can register where you are shopping and apply the cash back. So if you were buying socks on Amazon (yes I buy socks on Amazon), you would need to go to Ebates first, then click through to Amazon to get your cash back. Fortunately, there is a Chrome extension that automatically reminds you to do this, which is great because I always forget.

Ebates is probably the most well-known app on my list, and for good reason. It has relationships with a huge number of retailers, so you can get cash back for almost anything you buy online.

Ebates is currently giving out a $10 bonus when you spend $25 if you sign up through this link. (That’s my referral link. I get a small bonus in my Ebates account when you get a bonus.)

Ibotta

I am on the fence with Ibotta. I think it’s a great app to save money on groceries, and lots of people who use it rave about it. You can get cash back at almost every grocery store imaginable by selecting offers in the app on various products you buy on a weekly basis.

Related: How to Save Money on Groceries (And Still Eat Well)

Unfortunately, we do most of our grocery shopping at Aldi’s, which is like the one store not affiliated with Ibotta (but don’t feel too bad for me, Aldi’s is the best thing that’s ever happened to our grocery budget). We still do a little shopping at other grocery stores, and I make a few dollars here and there through Ibotta, but someone who shopped at a “normal” grocery store could make a lot more.

What I like most about Ibotta is that they consistently have offers for cash back on non-branded items. So you can get 25 cents off any carton of eggs, or 50 cents off any type of meat. You don’t have to overpay on name brand products just to get a discount. I’ll give it a few more months and see if it deserves a spot on my phone.

I do heartily recommend the app to anyone who shops at a grocery store other than Aldi’s. Ibotta advertises that their average user saves $20 per month ($240 per year) for a few minutes of work each week.

If you want to give it a try, you can get a $10 bonus when you start shopping with Ibotta here. (Like Ebates, I get a small bonus in my Ibotta account when you get your bonus.)

Get the 4 Apps I Use and a $30 Cash Bonus When You Sign Up Now!

Credit Card Rewards – $0

Last year, I decided to report the income when we actually cashed out the reward points. I am rethinking that, and may report the income when we receive the rewards. Most of our rewards are Chase Ultimate Rewards Points, which we can generally get a redemption rate of 1.5:1 on when we book travel, but I would just value them at a purely cash value of 100 points to $1.

Nothing to report for credit card rewards in March. We have a pretty good sized bank of Chase points stored up for future travel. We are planning a trip this summer, and trying to decide whether to fly or drive. If we fly, tickets are almost $500 each for a relatively short domestic flight, which is crazy to me. I need to look into credit card sign-up bonuses and get started on applying. If we take this trip it will definitely deplete our points.

We add about 3-4,000 points ($30-40) a month just from our normal credit card use, mainly on our Chase cards. We’ve got a balance of about 120,000 points right now, which at our average redemption rate of 1.5:1 is worth $1,800 toward travel costs. We try to open a couple new cards per year to get the sign-up bonuses. I don’t have the next one planned, so I need to get on that!

I absolutely love credit card rewards, as we haven’t paid for a plane ticket in almost 3 years now. I need to write a post about our strategy, but you can find lots of info online just by googling “travel reward hacking”.

How to Get Started With Credit Card Rewards (And Earn $600)

For the newbie, I recommend the Chase Sapphire card as your starting point. I signed up for one in my name, and another in my wife’s name over the last year to get a 50,000 point sign-up bonus for each of us (100,000 points total = about $1500 toward travel in our scenario above!)

You have to spend $4,000 on the card in order to get the bonus, so if you want to try the same thing make sure you space it out so you can hit the spending requirement. There is also a $95 annual fee. When I reach the anniversary on my card, I plan to call Chase and get it downgraded to a no annual fee card.

NOTE: This offer has since expired, and the current offer is even better. You can now get 60,000 bonus points after spending $4,000 in the first 3 months!

Check out the Chase Sapphire card here and see if you qualify for the 60,000 point sign-up bonus.

Interest Earned – $234

We have a decent amount of cash sitting around in emergency funds and reserve funds for our rental properties, as well as money waiting to be invested in passive crowdfunding projects.

This month we earned $234. Most of our money is in an Ally Bank account earning 2.2%, but I am working on moving it over to CIT Bank which consistently pays the highest interest rate I’ve been able to find (currently 2.45%).

CIT Bank Has the Best Interest Rate I Can Find Anywhere

If you’re looking for a good bank account to hold your emergency fund, or other cash savings, I highly recommend looking into CIT Bank.

By being online only they are able to keep expenses down and offer the best interest rate I can find without sacrificing service.

Realtor Commissions – $10,191

As part of our real estate investing side hustle (see below), my wife got her real estate license mainly to save on transaction costs for our own purchases. However, it costs a decent amount of money to maintain her license ($2-3k per year), so she takes on clients here and there. These are almost exclusively friends, family, and referrals. She doesn’t do any marketing to find clients.

My wife stays home with the kids (a much more than full-time job itself), but we’ve been surprised that she’s been able to net around $15-20k per year the last few years only working a few hours here and there. When she has a client, most of the work tends to be evenings and weekends, so I can watch the kids while she shows houses. I would say she spends less than 10 hours a month on this side hustle.

The realtor income is highly erratic. She might have a closing one month and make $5,000, and then not make any money for 3 or 4 months.

In March, she helped a client finally buy a house after almost a year of looking off an on. After broker fees and other costs, she made $10,191! This represented a 2.5% commission on a $440k house. If I had to guess, she’s probably spent about 60-80 hours over the last year before finally closing on this house. That works out to around $150 per hour. I wish she could get one of these every month, but it does take time away from the family so just having one client here and there is our current goal.

Related: Everything I’ve Ever Done to Make Money

Real Estate Crowdfunding – $758

Real estate crowdfunding brings in the holy grail of truly passive income. As we get busier with young kids and family life, we are trying to transition some of our gains from active real estate investing into more passive investments. Our real estate crowdfunding income represents the monthly income our invested capital is making for us each month.

If you don’t know what real estate crowdfunding is, you are basically contributing money to a large commercial real estate deal, either as a lender (debt) or as a part-owner (equity). The sponsor of the deal does all the work to find the property, negotiate it, fix it up, rent it out, and eventually sell it. You the passive investor just contribute capital to make the deal happen. You also get absolutely no say in how the property is run, so by far the most important aspect of my due diligence is looking at the sponsor and their past track record.

There are lots of platforms to get into real estate crowdfunding (RealtyShares – no longer accepting new investors, CrowdStreet, EquityMultiple, etc.) You can also find deal sponsors the old-fashioned way through networking with other people. That is how I’ve found most of the sponsors I’ve invested with.

I’m currently invested in a few different deals:

- A fund that invests in land deals and single family rental houses

- An apartment complex that happens to be 5 minutes from my house

- A fund diversified across multifamily, commercial, and industrial properties

- A fund that invests in Class C apartments in the Midwest

- A fund that invests in Class B/C apartments in the Southeast

- NEW FOR MARCH: A fund that invests in retail shopping centers

Over time, I generally expect my passive real estate investments to return 12-15% per year (IRR). They are all long term investments though, with the money locked up for 5-10 years. Some give me a monthly payment of the cash flow the property generates, and some don’t pay out until everything is sold off in 5 or 10 years.

March Update: This month, we got checks from 2 of our investments – one for $333 and another for $425.

We also used some of our cash sitting around earning 2.2% in the bank to invest in a fund that buys and manages retail shopping centers. Retail has been beaten up lately (somewhat unfairly in my opinion), and as such cap rates are higher. While there is some risk in retail of more and more shopping going online, there is some shopping that will always need to be done locally. I wouldn’t put my whole portfolio in retail, but the projected cash flow is good and the risk is diversified across several shopping centers, so I think it is good exposure for my real estate portfolio. We’ll see how things go!

If you’re brand new to real estate and don’t have a lot of money to invest, I would recommend starting small. Two platforms I like are Groundfloor and Fundrise.

- Groundfloor allows you to participate in loans backed by real estate (as little as $10 per loan last I checked). While I no longer contribute to my Groundfloor account, I got an annualized return of 12.5% over the past couple of years across all the various loans I helped to fund. If you’re interested in learning more about Groundfloor, click here. (get a $10 bonus when you open an account through that link!)

- Fundrise lets you invest in a diversified portfolio of real estate with as little as $500. Because it is a private fund and your money is tied up for 3+ years (unlike a public REIT) the returns tend to be higher, and the low minimum makes it a good introduction to crowdfunding. You can check out Fundrise here and see if it could help you meet your investment goals. (affiliate link)

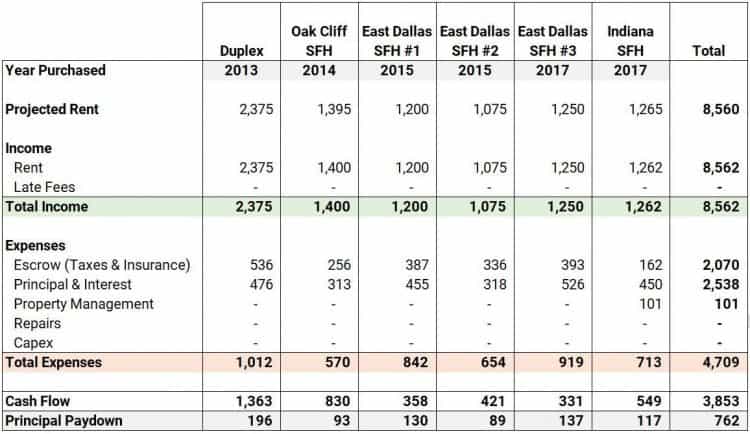

Rental Properties – $3,853

Rental properties is where our side hustle journey began. We are now 5 years in, and currently have a small portfolio of 7 units. We aim to make about $300 cash flow per month per unit, which has gotten harder to do the last couple years as real estate prices have risen. You can read the story of how we got started in real estate investing here.

All but one of our rentals we self-manage (one rental is in a different state), so we market the property, pick the tenants, and answer the phone when there are problems. Most months nothing happens and there isn’t really anything to do but deposit the rent, but sometimes we get an emergency call that water is pouring out from under the house and we have to figure out how to deal with it. We’ve built up a good list of contractors we trust, which has helped tremendously in keeping costs down and tenants happy.

Related: How to Use the 1% Rule to Find Great Rental Properties

One thing I don’t include in the cash flow is the principal paydown on the mortgage. While this isn’t money coming in to pay the bills, it does slowly increase our net worth as the tenants continue to pay down our mortgages. Here’s the breakdown by property:

Overall, if everything is running perfectly – we collect all the projected rent checks, and our only expense is the mortgage payment, we would cash flow about $4,000 per month. That is the absolute ceiling, and of course you have to factor in other expenses such as repairs, property management, and vacancy.

Here are the highlights for March:

- One of our tenants bought a house. The tenants on one side of our duplex bought a house and are moving out in a few days. When they move out, it will need some fairly extensive clean-up (needs new paint throughout, carpets cleaned, trees trimmed, leaning fence fixed, etc.), so we are lining up contractors to do that. We advertised it for rent and in one week had 110 inquiries! We did one open house and collected a bunch of applications. Hopefully one of them will work out, if not we will continue to advertise it until we find qualified tenants. I always get a little anxious when we are looking for new tenants. We have pretty stringent screening criteria, but it is always hard to make the best decision with limited information on who the next renter should be.

- We renewed 2 leases. The leases for East Dallas SFH #1 and #2 expire at the end of March. We got the paperwork signed to renew their leases for another term 🙂

I spent a significant amount of time responding to emails and holding an open house for the unit we are looking to rent out – maybe around 10 hours this month. Most of the work comes when we are in the process of finding a new tenant, so that is to be expected. Other than that, the only other time spent on the rentals was putting this blog post together!

Blogging – $215

I’ve earned a few affiliate commissions from products I’ve recommended (thanks to those of you who signed up using my links – I’d love to know what you think of the products!)

I actually got my first checks this month! That $215 represents probably 3 or 4 months worth of affiliate income that finally paid out. It’s not a ton of money, but it’s a start. I’d love for my blog to eventually make $3-5,000 per month, but that is a long time away.

For now, I am really enjoying the process of writing out my thoughts on various personal finance subjects, and trying to figure out what kinds of content my audience gets the most value out of.

For example, I recently wrote an article on the Federal Employee Pension Calculation for one specific person (although I hope it helps more people in similar situations). So if you have suggestions for things you want to hear about – let me know!

If you want to see our past income reports, check them out below:

What do you do to make extra income on the side? Let me know in the comments!

[ad_2]

Source link