There is a lot of confusion around retirement, and particularly recommended retirement savings by age.

How much should you have saved by age? And how much do you need in retirement?

A lot of words have been written to try to answer these questions, but the real answer is…it’s complicated.

It’s not complicated because the math is hard, or there is some secret the experts know that you don’t. It’s complicated because there are so many variables to account for. When will you retire? How much do you plan to spend in retirement? Do you have a pension? How much will social security pay? How are your retirement funds invested? What assumptions should you make about annual returns?

It’s enough to make your head spin.

And did you know the #1 method people use to estimate how much money they need for retirement is guessing? (According to a study done by the Transamerica Center for Retirement Studies)

Crazy! We can do better than that.

Simple Method to Calculate Recommended Retirement Savings by Age

While not perfect, Fidelity came out with a simple formula to calculate how much you need to retire, and how much you should have saved by age for retirement. If you are the typical household making around the median wage and plan to retire at the normal retirement age, then this simplified rule of thumb is a good place to start (certainly better than guessing!)

How Much Do I Need To Retire?

Fidelity’s calculations take into account assumptions such as how much of your income will be replaced by social security, the age you retire, and estimated investment returns.

- If you plan to retire at the full retirement age of 67 (as currently defined), you should have 10X your income saved.

- If you plan to retire at 65, you should have 12X your income saved (to compensate for a lower social security payout).

- If you plan to retire at 70, you should have 8X your income saved (because of the higher social security benefit).

Of course there are a lot of assumptions involved, but as a rule of thumb, it is a great place to start. Most people do not drastically alter their lifestyle after retirement, so basing it on your income is a reasonable assumption. And this method gives a quick and easy method to calculate if you are on track or not.

How Much Should I Have Saved for Retirement by Age?

You can also track your progress at different ages to see how you measure up for retirement. Here are the recommended retirement savings by age if you plan to retire at 67:

- By age 30, you should have 1X your annual income saved

- By age 40, you should have 3X your annual income saved

- By age 50, you should have 6X your annual income saved

- By age 60, you should have 8X your annual income saved

- By age 67, you should have 10X your annual income saved

How Much of My Annual Income Should I Save for Retirement?

If you need 8-12X your annual salary saved in order to retire, what does that translate to in the form of annual savings rate? Most generic personal finance advice says you should save 10-15% of your income for retirement.

With a little back-of-the-envelope math, if you started saving at age 25, and were able to get an average 5% return on your investments after inflation, here is how you would stack up at 10% and 15% savings rates. For simplicity, let’s also assume you don’t get any raises (and therefore don’t inflate your lifestyle along the way).

10% Annual Savings Rate

- At age 30, you would have 0.7X your income saved

- At age 40, you would have 2.5X your income saved

- At age 50, you would have 5.4X your income saved

- At age 60, you would have 10.1X your income saved

- At age 67, you would have 15X your income saved

15% Annual Savings Rate

- At age 30, you would have 1.1X your income saved

- At age 40, you would have 3.7X your income saved

- At age 50, you would have 8.1X your income saved

- At age 60, you would have 15.1X your income saved

- At age 67, you would have 22.5X your income saved

As you can see, in either scenario, the power of compounding helps you out and you would easily meet the recommended retirement savings by age. The earlier you can start saving for retirement, the more time your money has to grow.

The point of these goals is not to stress out or feel defeated if you are behind. There are plenty of things you can do to catch up, especially if you are younger. If you follow the simple steps to financial freedom, you can pay off debt, find easy ways to save money and free up additional resources to invest, and even find ways to make extra money through side hustles or other opportunities.

Average Retirement Savings by Age

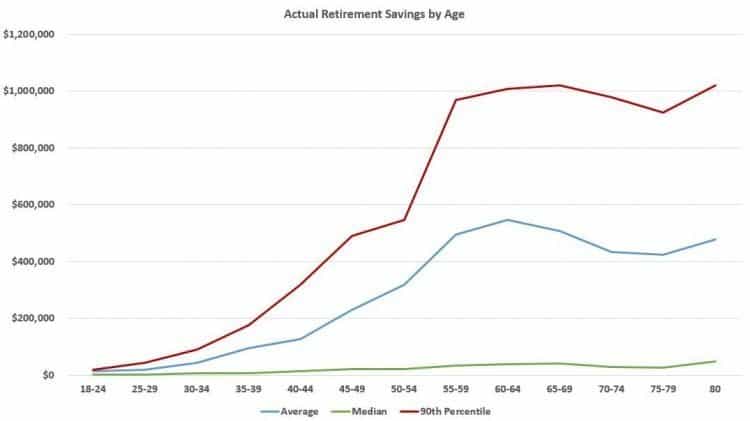

Moving on from the recommended retirement savings by age, how much do households actually have saved by age? The answer may surprise you.

According to 2016 data from the Federal Reserve (and thanks to analysis from DQYDJ), the median retirement savings for someone in their prime working years is only around $20 – $30,000!

The average looks much better, and generally appears to follow the recommended retirement savings by age from above. Part of the reason for the income and savings rate disparity among American households is just that there are so many households with zero savings or even carrying extensive debt.

If you take anything away from this article, know that just by thinking about and planning for your retirement, you are light years ahead of most households in America!

Here are the retirement savings by age for American households for 3 different scenarios – average, median, and 90th percentile (the top 10% of savers). How do you stack up to these figures?

How to Save for Retirement – Recommendations by Age

Regardless of what life stage you’re in, there are some easy things you can do to better prepare for retirement. Here’s what you should be doing at every age.

Saving for Retirement in Your 20s

In your 20s, one of the best things you can do is establish good personal finance habits. Make a budget, spend less than you earn, and learn to set aside a certain percentage of your income not only for retirement, but also for near term expenses such as a new car or vacation.

Student loan debt can be a major burden in your 20s, so paying this down as quickly as possible can help you get on track for retirement and a positive net worth. The earlier you can start saving, the more the power of compound interest can help you build a solid retirement nest egg in the future.

Your 20s is a great time to focus on growing your income. For the most part, 20-somethings are without kids or a mortgage. As you get older and your priorities shift, it becomes harder to find time to pursue everything you can in your 20s to advance your career.

For example, I got married in my late 20s, and my wife and I chose to pursue real estate as a means to build additional wealth for our future. We worked hard to build our rental property portfolio and side hustle income, and now that we are older and have kids we can slow down and still enjoy some passive income coming in.

Ideally you should aim to have 1X your annual income saved for retirement by age 30. But understand that everyone’s situation is different, and you should adjust your plan accordingly.

Related: Dave Ramsey’s Recommended Household Budget Percentages for a Healthy Budget

Saving for Retirement in Your 30s

I’m in my 30s now, and I can definitely say that adding kids to our family, along with a mortgage and all that comes with it has definitely stressed our budget a bit.

But in your 30s, you should also have been able to increase your paycheck, and if you can avoid the temptation of lifestyle inflation, this gives you an opportunity to funnel even more money into your retirement accounts.

Make sure you are taking full advantage of your employer’s 401(k) match if they give it (that is free money!) If you can continue to keep up the good financial habits you learned in your 20s, you should be able to stay on track in saving for retirement.

Ideally you should aim to have at least 3X your annual income saved for retirement by age 40.

Saving for Retirement in Your 40s

If you have been diligent in your 20s and 30s to pay down student loan debt and not get trapped in the cycle of keeping up with the Joneses, keep up the good work! If you haven’t been as fortunate, there is still plenty of time to make up for past financial mistakes.

While I’m not in my 40s yet, I imagine that as our kids get older and more involved in different activities, the costs will only go up. It is more important than ever in your 40s to make sure you have a budget, and to pay yourself first by saving for retirement. Keeping lifestyle inflation under control can be a challenge.

If you are fortunate enough to have done well in your career thus far, look at what it would take to max out your 401(k) ($19,000 in 2019) and IRA ($6,000).

Ideally you should aim to have at least 6X your annual income saved for retirement by age 50.

Saving for Retirement in Your 50s and Beyond

After age 50, Uncle Sam helps you out a little by allowing you to contribute even more to your 401(k) and IRA. If you are getting a late start, now is the time to buckle down, trim the budget, and contribute as much as you can to your retirement accounts.

For my own family, when we are in our 50s we will be looking at the kids’ college expenses and a (hopefully) empty nest thereafter. It should get easier to save during the empty nest phase, but of course you want to keep up your savings rate throughout your 50s if you can.

If you’ve been on track thus far, you should have a sizeable portfolio, and managing that portfolio well becomes even more important than what you contribute. Make sure you are diversified in your investments and your risk – as you approach retirement you don’t want to be 100% in stocks and potentially lose half your retirement fund in a recession.

Ideally you should aim to have at least 8X your annual income saved for retirement by age 60, and 10X by age 67.

Related: 401(k) Mistakes to Avoid

Get a FREE 401(k) Health Check

I recently used an online tool called Blooom to do a “health check” of my 401(k) for free. It asked me a few questions about my retirement plans, risk tolerance, and age, and gave some recommendations of ways to save money on fees, and diversify for better potential returns.

I was pretty impressed with the advice they gave for free and was able to use it to make a few tweaks to my portfolio!

Click here to take Blooom’s free 401(k) health check and get a quick analysis of how you’re doing.

There’s really nothing to lose, and they don’t pull any tricks like asking for your credit card before giving you the full results.

There is a paid plan if you want Blooom to make the changes to your portfolio and continually monitor for improvements, but you certainly don’t have to use it if you’re comfortable getting your hands a little dirty in your 401(k) portal. I was able to take their free advice and make the changes myself.

The Ultimate Goal: Take Control of Your Retirement

While this article has presented a good rule of thumb to follow for recommended retirement savings by age, there are no hard and fast rules when it comes to retirement savings.

But no matter what age you are, NOW is the time to start planning. If you are young, retirement can seem far off and unimportant. And if you are older, it can feel overwhelming to make up for lost time.

If you find yourself struggling to get started, my advice is to break it down into smaller goals that you can achieve. Saving 10X your income doesn’t happen overnight, but it is definitely possible to get there! For example:

Making small adjustments can add up to big dollars over time. And if you keep the big picture goal in mind, you are well on your way to a comfortable retirement!

[ad_2]

Source link